Effortless Riches: Examining the Myths and Realities

페이지 정보

작성자 Nichol 댓글 0건 조회 4회 작성일 25-12-18 20:58본문

In today's society, the concept of "easy money" has become a tempting subject for countless people. With the growth of virtual money, internet-based markets, and an array of rapid wealth strategies, the allure of gaining wealth easily is increasingly widespread. However, while the idea may sound appealing, it is essential to evaluate the facts and misconceptions surrounding easy money, to understand the dangers and benefits that are involved.

The Allure of Easy Money

The idea of accumulating wealth without the traditional routine of a regular job is absolutely attractive. Many dreamers wish for financial freedom, where they don’t need to worry about bills or barely covering expenses. This desire has led to a surge in curiosity in multiple paths that offer instant profits.

From web questionnaires to affiliate marketing, and crypto investing to shares trading, the internet is overflowing with opportunities that advertise instant wealth. The selling point is simple: minimal effort for maximum reward. However, the reality is often far different.

Common Misconceptions about Easy Wealth

- Guaranteed Returns: One of the widespread myths is the idea that certain ventures come risk-free. In reality, no investment is risk-free. The higher the potential return, the bigger the danger. Promises of guaranteed returns are often red flags for fraudulent schemes.

- No Skills Required: Many assume that making easy money needs no expertise. However, most real opportunities for gaining income—whether in trading—require knowledge, awareness of trends, and strategic thinking.

- Everyone is Doing It: The hype of a scheme does not equate to its safety. Just because a majority are participating, does not mean it is a sound investment. Following the crowd can lead to serious mistakes when the market drops.

- Get Rich Quick: The idea that one can achieve wealth overnight is harmful. Most wealthy people have struggled, experienced losses, and gained wisdom. Quick fixes seldom lead to lasting wealth.

- Passive Income is Easy: While passive income can be authentic, it usually needs major upfront work or investment. Creating digital education, writing a bestselling book, or building a rental property portfolio requires dedication.

The Realities of Easy Money

- High Risk: Most ventures that promise fast income come with high risks. For example, speculative stock moves can yield rapid income but can also lead to devastating losses if not approached with care and understanding.

- Scams and Frauds: The online world is a hub for scams, and many opportunities that advertise fast profits are simply traps set up to deceive from unsuspecting individuals. Always check in detail before joining.

- Time Investment: Even paths that promise passive income demand a lot of time. For example, starting a blog takes dedication to attract followers and monetize.

- Emotional Stress: The pursuit of quick riches can lead to mental strain. The fear of losing can take a toll on mental health. A healthier approach to earning often leads to longer-term happiness.

- Sustainable Wealth: Building lasting wealth demands hard work, financial discipline, and future-oriented actions. Real financial success is often the fruit of disciplined saving, strategic investing, and knowledge growth.

Authentic Paths to Income

While the attraction of easy money may be misleading, there are authentic methods to gain income that can be both rewarding and worthwhile. Here are a few alternatives to consider:

- Investing: While investing in stocks, bonds, or real estate comes with uncertainty, it can also provide major long-term gains. Educating yourself economic systems, balancing risk, and planning strategically can minimize losses.

- Side Hustles: Many individuals gain results through part-time projects that use their talents. Freelancing, coaching, or selling handmade crafts online can provide extra income while letting you follow hobbies.

- Online Courses and Content Creation: If you hold skills in a particular field, creating online courses or content can be a way to earn recurring revenue. Platforms like Teachable allow you to share your knowledge while building income over time.

- Real Estate: Buying property can be a strong strategy for building wealth. While it requires upfront capital and research, leased homes can provide steady income and gain long-term growth.

- Peer-to-Peer Lending: Participating in peer-to-peer lending platforms gives the opportunity to individuals to offer capital to others in exchange for interest. Although it carries risks, it can be a means of income while supporting borrowers.

Conclusion

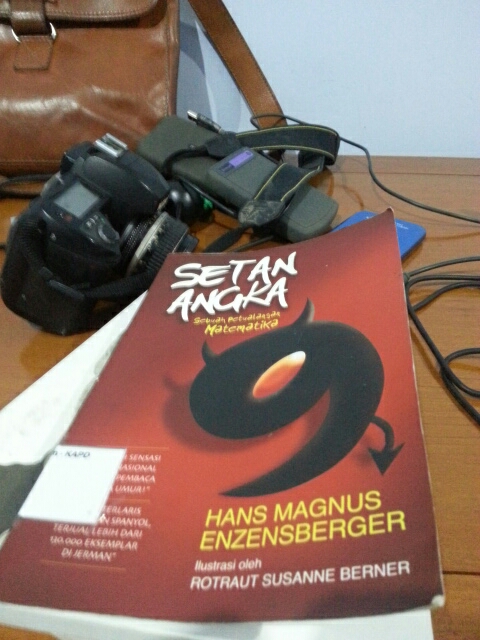

The concept of easy money is often covered with false promises that can lead individuals to risks. While the desire for wealth is common, Angka Setan Terbaru it is important to think critically.

True wealth is achieved through awareness, effort, and perseverance. By focusing on real paths for wealth, and being aware of dangers, earners can achieve sustainable financial success without succumbing to the allure of quick profits. Appreciate the path, grow your skills, and remember that financial freedom is often a gradual process, not immediate.

댓글목록

등록된 댓글이 없습니다.